Livewire | The stock that has L1 Capital International's Steinthal most excited

And why the US remains “the best house on the street"

This article was first published by Chris Conway in Livewire Markets on 12 March, 2024.

The L1 Capital International Fund, managed by David Steinthal, recently held an investor webinar discussing the macroeconomic environment, key takeaways from the recent results season, and the performance of the Fund, which, as at 29 February 2024, has delivered a net return of 42.7% over the past year (MSCI World 29.4%) and 15.3% p.a. (MSCI World 13.5%) since inception on 1 March 2019.

The presentation also shone a light on one stock that stood out from the season, which has Steinthal particularly excited.

The macro

Steinthal opened by acknowledging that “how we’ve been talking about the macro environment for the past 18 months continues to play out. I gave an update three months ago and in our view, things have continued in a very similar manner, with a slight deterioration in economic indicators”.

He had the following to say about the key macro factors:

Inflation: “Inflation is already cooling quite considerably and we’re seeing that in the data, it’s a continuation of a trend that’s really been going on now for more than a year. Goods inflation is already negative, and we’re starting to see some of the stickier areas of inflation, particularly around housing and wages, come down.”

Employment: “Employment is really strong at the moment, particularly in the US, so [the Fed is] meeting their objective around employment, but inflation is still above their target.”

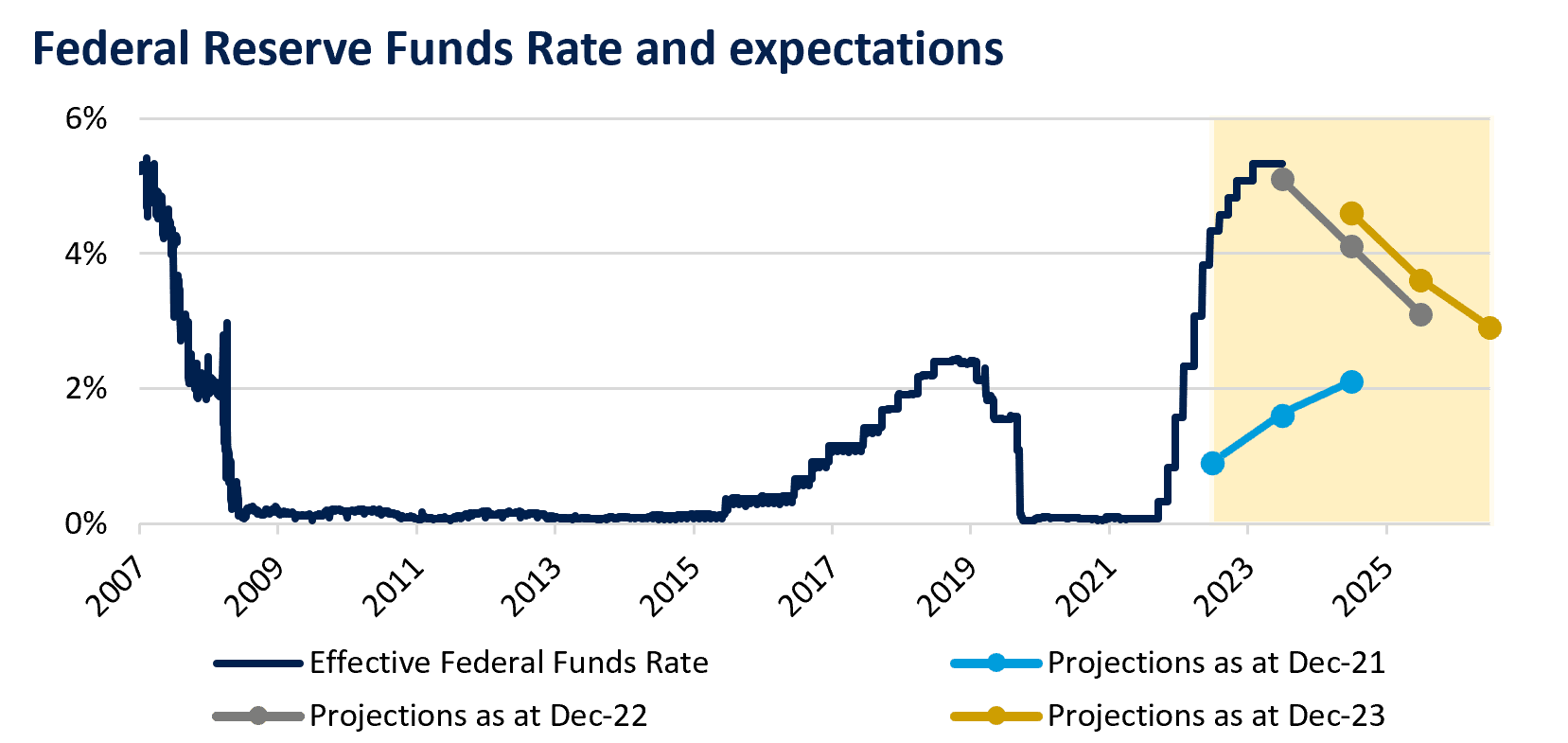

The path of interest rates: “The market has got a little bit ahead of itself in terms of expecting interest rates to come down in the US.”

You can see that in the chart below, which shows short-term interest rate expectations.

Source: St Louis Federal Reserve, Federal Open Market Committee.

The consumer: “We generally see consumers doing OK. The middle consumer is actually doing quite well. We see that in aggregate spending data on Visa and Mastercard: the total amount being spent is increasing, albeit the rate of growth is slowing.”

Hard or soft landing: “From an overall macro perspective, we’re still expecting a soft landing, particularly in the US.”

Other economic geographies: “Europe is very slow, and the UK as well. It’s tough in Europe. They’ve got challenging demographics and it’s just not as easy an environment for businesses to operate in. It’s definitely weak.

China is the area that we’re really trying to minimize our exposure to. It looks very weak to us and has stayed weak although it’s probably starting to bottom out. It was a lot weaker than when everyone was expecting coming out of COVID.

And then from a [global] geopolitical risk perspective, there’s really nothing new to add. It remains a very unpredictable environment.”

Earnings season for the L1 Capital International Fund’s top 10 holdings

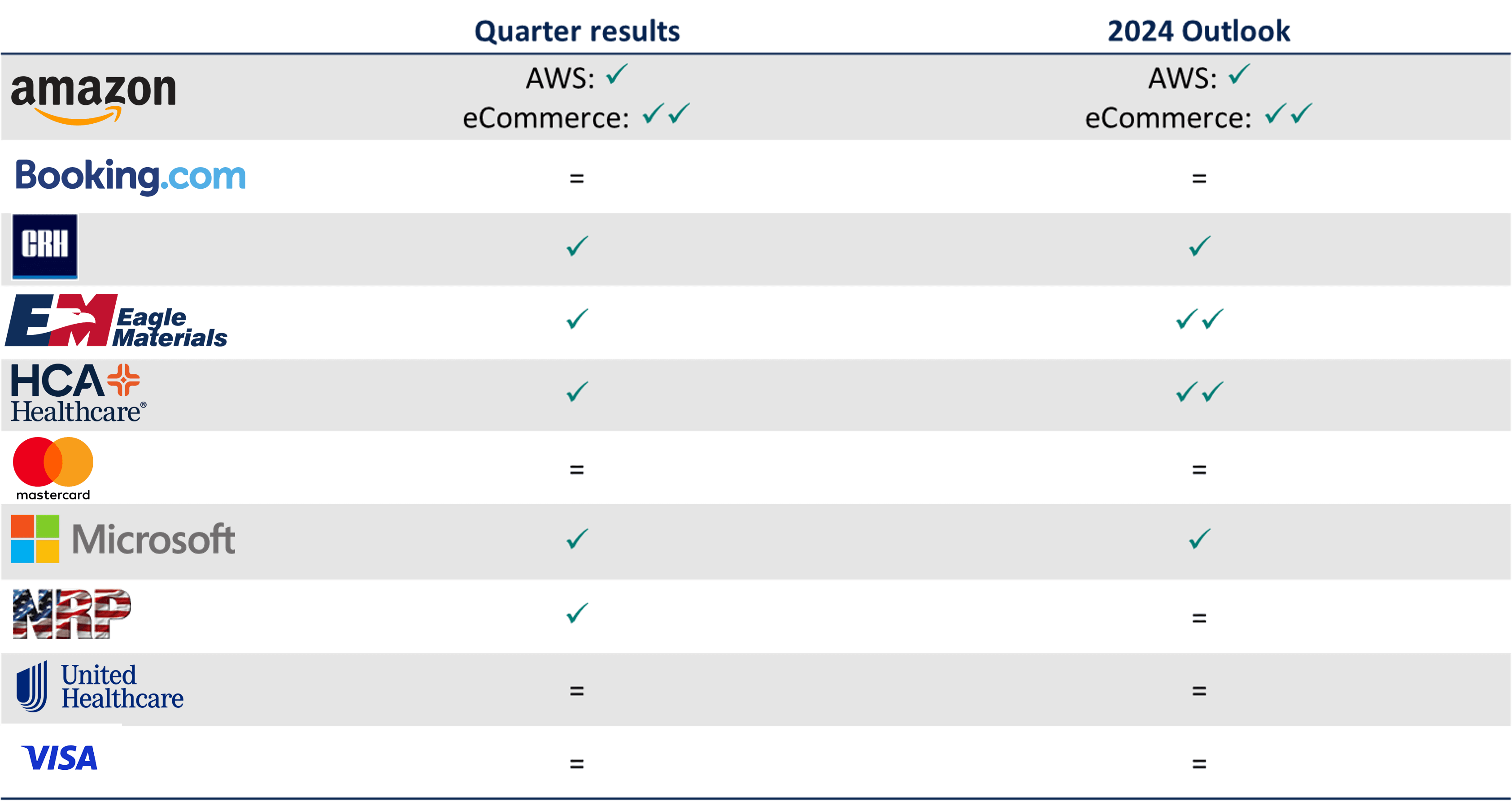

Source: Source: L1 Capital International

In the presentation, Steinthal focused on the Fund’s top 10 holdings, as seen in the table above. Below are highlights of the commentary for each stock.

Amazon (NASDAQ: AMZN): “Amazon was a stand-out for us.”

Booking Holdings (NASDAQ: BKNG): “The largest online travel agent met our expectations. It’s continuing to perform extremely well. The share price actually dropped 10% on results but that needs to be looked at in context. It’s almost doubled over the past 15 months. The share price was up 5% the day before results and the share price is still at the price that it was at the end of January.”

CRH (NYSE: CRH): “One of the largest building products businesses in the world, particularly in North America. It hasn’t reported yet but has given clear guidance. All their peers have reported and we expect a very in-line result. The share price has done very well but we still see good value.” CRH subsequently reported results and provided outlook commentary ahead of L1 Capital International’s expectations.

Eagle Materials (NYSE: EXP): “There’s limited stock of existing homes being sold [in the US] which means that there’s more demand for new homes, and Eagle Materials is benefiting from that. This is a company that’s delivered outstanding returns to investors over the long run.”

HCA (NYSE: HCA): “The largest for-profit hospital operator, as well as outpatient services provider in the United States. The company continues to exceed our expectations. There’s been a little bit of a pickup in demand for healthcare services.”

Mastercard (NASDAQ: MA) and Visa (NASDAQ: V): “Aggregate spending on Mastercard and Visa continues to increase. Growth rates are slowing, but still growing nicely. We still feel people underappreciate the additional revenues that Mastercard and Visa are getting beyond using their Visa or Mastercard debit or credit card in the shop. There is a whole range of business-to-business transactions and value-added services around security and the like. So these are compounding businesses, and we remain comfortable with their valuations.”

Microsoft (NYSE: MSFT): “The largest position in our portfolio. In our view, this company continues to exceed expectations, and we remain comfortable with the valuation. Every part of the business is doing extremely well, and we think it will continue to compound. We think it’s fair value but we think we can continue to generate double-digit type returns even from the current share price.”

NRP (NYSE: NRP): “Hasn’t reported yet but it’s a very formulaic expectation for this company. This is the kind of business you just wouldn’t see in someone else’s portfolio. It’s actually a mining royalty business. It doesn’t have any exposure to the cost pressures that a lot of mining companies are facing. It just clips the ticket through a royalty, and it’s got a very aligned management who own nearly 30% of the company. It’s up over 60% over the last six months, but we still see a lot of upside from here.” NRP subsequently reported results in line to ahead of L1 Capital International’s expectations.

United Health (NASDAQ: UNH): “The largest healthcare insurance company in the United States. It’s another steady compounder doing very well in this environment and does not have a lot of macro sensitivity.”

The one stock that stands out above all

The one stock that Steinthal spent most time focusing on was Amazon, noting;

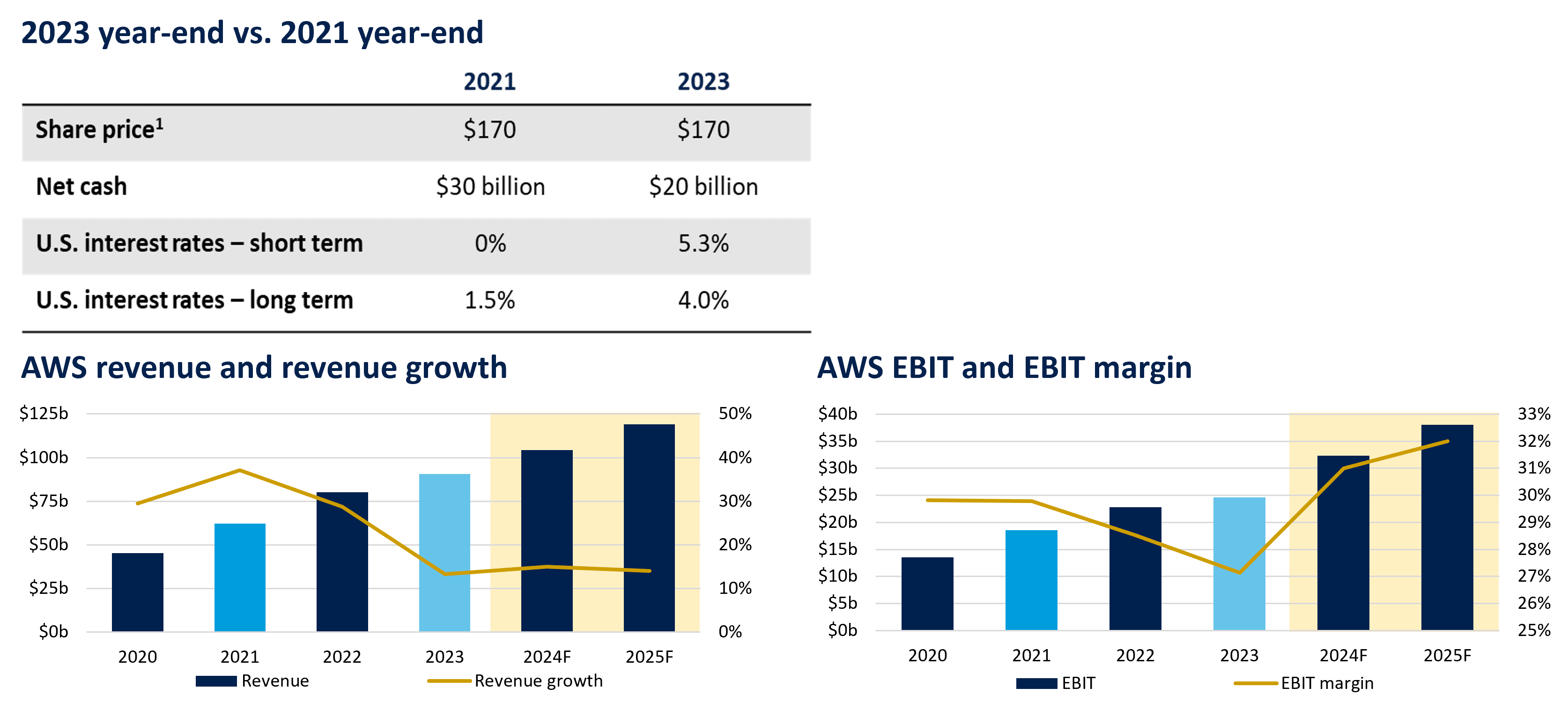

He went on to compare the end of 2021 and 2023 for the company, noting that the share price of US$170 today is the same as what it was at the end of 2021.

The difference between the two periods? The macro environment, notes Steinthal.

“We had COVID and we also had zero interest rates, compared to today’s much higher interest rates, both on the short end and the long end. So you can see 5.3% short end compared to 0% when the Fed was keeping rates at zero.

And the long end; the 10-year today is around 4%. Back then, it was around 1.5%. But the share price of Amazon was the same. I just wanted to highlight that the environment was different from a macro perspective” said Steinthal.

Source: Amazon and L1 Capital International. 1. Split adjusted.

Whilst the macro environment has changed, so too has the Amazon business. From Steinthal;

“When you’re looking at Amazon, you’ve got to think about two parts of the business. Amazon Web Services (AWS) and then, sort of, everything else. Let’s start with AWS.

The only company that’s better positioned than AWS in our view is Azure, which is owned by Microsoft, and we have positions in both. But it’s not a case of one or the other, they’re both doing really well.

This is a business that can continue to grow revenue at a consistent, well above double-digit rate, and expand its margins over time.

It is capital intensive, but in our view, a business that can invest a lot of capital and generate a high return on that capital is one of the best businesses to own, and that is AWS.

So compared to 2021, it’s just a continuation, except it’s much bigger and continuing to get stronger.

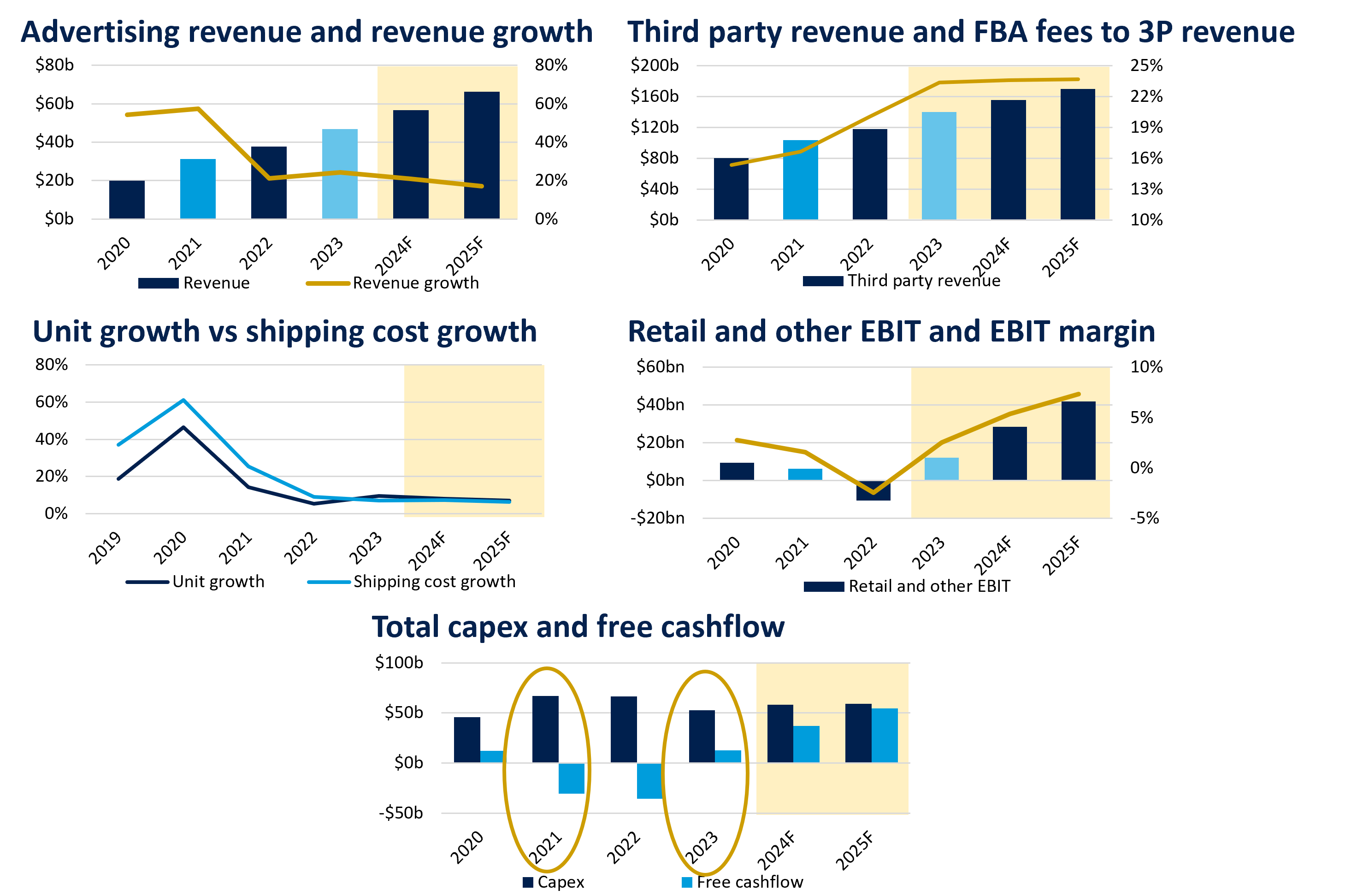

As for the other positive aspects of the business, Steinthal sees advertising and third-party fees driving profitable growth, whilst operating and capex efficiencies are also improving, driving improved profitability and increasing free cashflow.

Source: Amazon and L1 Capital International

Summary

In summary, Steinthal highlights that the Fund’s approach is about “quality, strong businesses in well-structured industries, with great, aligned management and not too much leverage. That can mean we invest in some “Growth companies”. It can also mean we invest in “Value companies”. We don’t like those terms – for us it’s Quality. We also don’t just invest in the mega caps. We also invest in companies that are in the US$1-10 billion-dollar market cap range.

We have tilted the portfolio to be a little bit more defensive. That’s not really targeting the macro environment. It’s more that that’s where we’re seeing the opportunities in healthcare or companies that are less macro-sensitive. And the areas that we think are getting a little bit frothy are the areas of tech that are acutely focused on AI.

We see our portfolio as fairly valued overall, but we still see the opportunity to compound wealth at a double-digit rate.”

Additional resources

Learn more about the L1 Capital International Fund